-

Can I use Zelle® to send funds from my First National account?

Yes, when you have a First National account, you can send money to people you know using Zelle® in your online banking account or FNBApp.

-

How do I enroll in Zelle®?

- Log into consumer online banking.

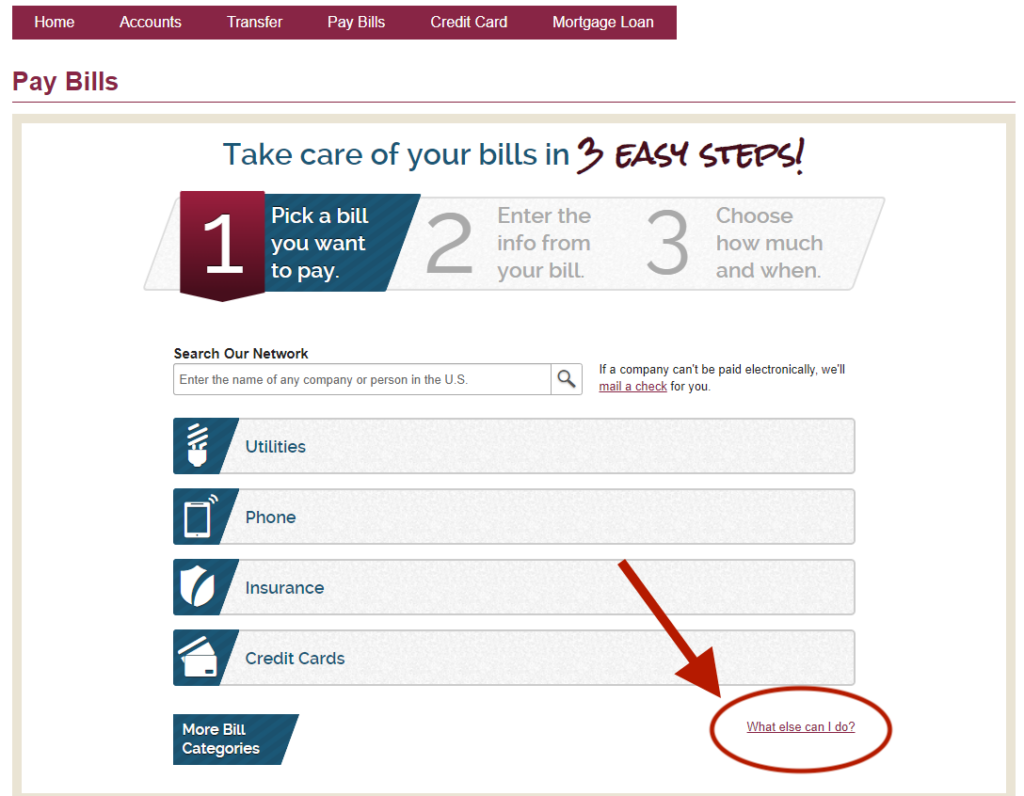

- Click on Pay Bills tab.

- Read and agree to the Terms of Service and click Enroll.

- Enter your mobile phone number and click Enroll.

- Read the Terms of Service for Bill Pay and Zelle and click the “I Accept” button and click Continue.

- Read the Privacy Policy, click the “I Accept” button and click Continue.

- To enroll in Zelle, click on “What else can I do?” at the bottom of the screen.

- Navigate to the “Send Money with Zelle” tab.

- Click on “Get Started.”

- Select either your email address or phone number on file and click continue.

- If you select your phone number, read the disclosure and click Ok for the notice on receiving text messages.

- Open your SMS messaging app, enter the six-digit code sent via text, and hit “Verify.” Do not share this information with anyone.

- Review the account information (last four digits of account) and click “Confirm Account.”

- You’re all set up! Click “Send Money” to send your first Zelle payment.

-

What if I need help with Zelle®?

Customer Service is available during normal banking hours to answer questions. Call 907-777-4362 or 800-856-4362.

-

Is my information secure with Zelle®?

Keeping your money and information safe is one of our top priorities. When you use Zelle® within our mobile app or online banking, your information is protected with the same technology we use to keep your bank account safe.

-

Can I cancel a Zelle® payment?

You can only cancel a payment if the person you sent money to hasn’t enrolled with Zelle® yet. To check if the payment is pending because the recipient hasn’t enrolled, go to your activity page, choose the payment you want to cancel, and then select “Cancel This Payment.”

If the person you sent money to has already enrolled with Zelle®, the money is sent directly to their bank account and cannot be canceled. This is why it’s important to only send money to people you trust and always ensure you’ve used the correct email address or U.S. mobile number when sending money.

If you sent money to the wrong person, we recommend contacting the recipient and requesting the money back. If you aren’t able to get your money back, please contact customer service at 907-777-4362 or 800-856-4362.

-

Is it safe to send money with Zelle® to people I don’t know?

Since money is sent directly from your bank account to another person’s bank account within minutes, Zelle® should only be used to send money to friends, family, and others you trust.

If you don’t know the person or aren’t sure you will get what you paid for (for example, items bought from an online bidding or sales site), we don’t recommend using Zelle®. Neither First National nor Zelle® offers a protection program for any authorized payments made with Zelle®.

-

Can I use Zelle® internationally?

No. Zelle® can only be used with U.S. bank accounts.

-

How long does it take to receive money with Zelle®?

Money sent with Zelle® is typically available to an enrolled recipient within minutes. Ask your recipient to enroll with Zelle® before you send them money—this will help them get your payment faster.

If you send money to someone who isn’t enrolled with Zelle®, they will receive a payment notification prompting them to enroll. After your recipient enrolls, it may take 1 to 3 business days for them to receive the payment in their bank account. This is a security feature of Zelle® designed to reduce risk and protect you whenever you’re sending or receiving money. Once the payment is processed, the recipient will be able to receive future payments faster, typically within minutes.

If it has been more than three days since the payment was initiated, we recommend confirming that the person you sent money to has enrolled with Zelle® and that you entered the right email address or U.S. mobile number.

If you’re waiting to receive money, double-check to see if you received a payment notification. If you didn’t, follow up with the sender. Also, make sure that the email address or mobile number you enrolled with is the same email address or mobile number to which the money was sent.

-

Are there any fees to send money using Zelle®?

First National does not charge fees to use Zelle®. Message and data rates may apply when using the mobile FNBApp.

-

How do I unlock my Zelle® account?

If you’ve received a notification that your Zelle® account is locked, give us a call at 907-777-4362 or 800-856-4362.

-

How do I send money using Zelle®? How do I receive money with Zelle®?

- Using the FBNApp, sign into your account.

- From the home page, click Transfer & Pay.

- Under the Payments section, click Send Money with Zelle®.

- Click Send.

- Select or add the recipient.

- i. If the recipient is listed, select their name and continue to the next step.

- ii. If the individual is not listed, select Add New Contact. Enter the recipient’s first and last name into the appropriate name fields. Select a contact method for the recipient (email address, mobile phone number, or account number) and enter the appropriate information into the contact field.

- Review the Keep Your Money Safe pop-up to ensure the money is being sent to someone trustworthy. Click Next to send the money.

- Complete the Enter Amount screen.

- Ensure the correct recipient has been selected.

- Enter the dollar amount to be sent.

- Review the delivery date and type.

- To modify the delivery type and/or delivery date, click Change and make the appropriate correction.

- To change the delivery type, select the appropriate option in the Frequency drop-down list.

- To change the delivery date, select the appropriate date in the Calendar.

- Click Done.

- Review the “From My” field to ensure it lists the correct account. If not, click Back to the Transfer & Pay screen to select a different account.

- Click Review.

- Complete the Review and Send screen.

- Ensure the dollar amount, recipient name and contact information is correct.

- If desired, enter a message into the Reason field (Optional, maximum 20 characters).

- Click Send to pay the recipient.

Page 1 of 1