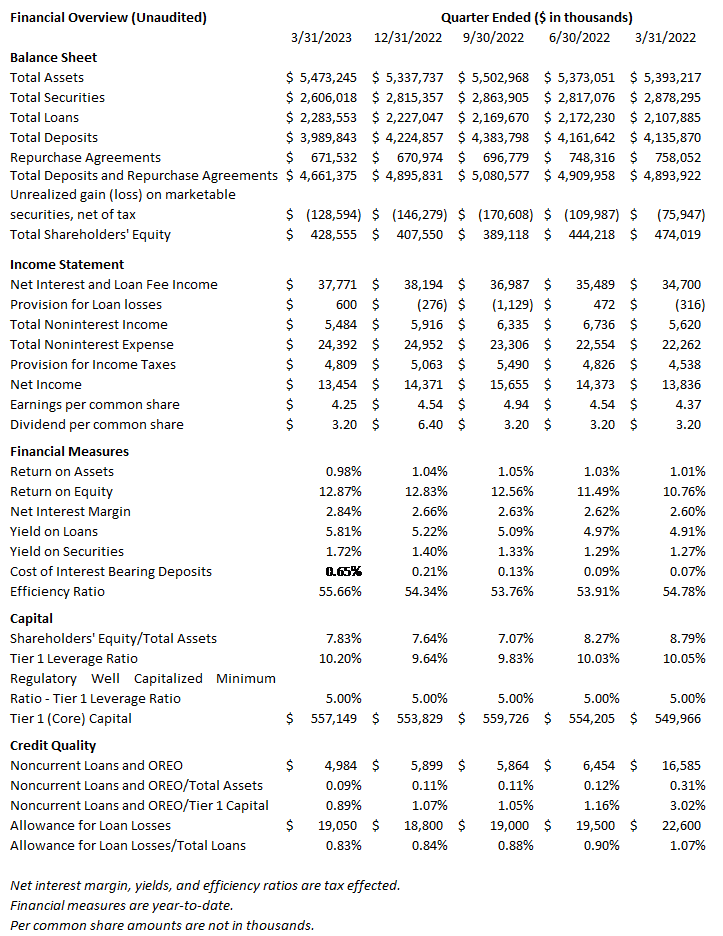

ANCHORAGE, AK – First National Bank Alaska’s (OTCQX:FBAK) net income for the first quarter of 2023 was $13.5 million, or $4.25 per share. This compares to a net income of $13.8 million, or $4.37 per share, for the same period in 2022.

Deposits and repurchase agreements totaled $4.7 billion as of March 31, 2023, compared to $4.9 billion one year earlier and as of prior year end, reflecting deposit outflow during the first quarter of 2023. Bank deposits grew by $1.8 billion during 2020 and 2021 combined. The net deposit outflow was anticipated as pandemic restrictions ease, consumer travel and discretionary spending resume momentum, seasonal business activities ramp up, and grants and other earmarked funds are utilized.

Interest and fees on loans increased $6.9 million. Interest and dividends on investment securities increased $3.3 million year-over-year, due to the rising interest rate environment. The blended yield on interest-earning assets increased to 3.53% from 2.64% for the three-month period ending March 31, 2023 and 2022, respectively. Cost of interest-bearing deposits increased from 0.07% for the three months ending March 31, 2022 to 0.65% for the three months ending March 31, 2023. The year-to-date net interest margin moved to 2.84% compared to 2.60% for the three months ending March 31, 2022.

Noninterest income for the first quarter 2023 decreased 2.42% from the first quarter 2022. During the first quarter, $0.3 million of losses on available-for-sale securities was recognized through the sale of securities. Noninterest expenses for the first quarter 2023 increased 9.57% compared to the first quarter 2022. Salaries and employee benefits increased year-over-year due to market wage adjustments and medical benefits expenses.

Total loans increased $175.7 million year-over-year. At March 31, 2023, delinquent loans from 30 to 89 days were $3.6 million, 0.16% of outstanding loans, with no change compared to Dec. 31, 2022. Nonperforming loans were $4.8 million, 0.22% of outstanding loans, a decrease of $0.9 million from Dec. 31, 2022. The allowance for credit losses at March 31, 2023, was $19.1 million, 0.83% of total loans.

“First National continues to do what we do best – making sound business decisions and strengthening relationships with people and businesses who appreciate working with a team of Alaskans who has their back,” said Board Chair and CEO/President Betsy Lawer. “Effective, consistent banking decisions are not a response to the moment but a cornerstone of who we are.

“To take advantage of the favorable pricing and terms of the facility, and to proactively mitigate the potential risk of normal seasonal and cyclical deposit outflows and maturity timing in our investment portfolio, the bank borrowed $350 million under the Federal Reserve Bank Term Funding Program in March 2023,” Lawer added.

The program allows banks to pledge securities at par, hold securities with unrealized market losses to maturity, and reduce the risk of impact on earnings and capital of early sales. The borrowing level was equivalent to the bank’s volume of securities maturing from the borrowing date through Dec. 31, 2023. The debt carries fixed interest at 4.37% and matures in March 2024. The bank maintains ample liquidity for operations and future growth through the combination of cash, unpledged securities, and borrowing facilities with the Federal Reserve and the Federal Home Loan Bank of Des Moines.

Assets totaled $5.5 billion as of March 31, 2023, increasing $135.5 million during the first quarter. Return on assets for the three months ending March 31, 2023, was 0.98%, decreased from 1.01% for the same period last year. At that time, total assets were lower by $80.0 million at $5.4 billion.

Shareholders’ equity was $428.6 million as of March 31, 2023, compared to $407.6 million as of Dec. 31, 2022, an increase of $21.0 million resulting from an increase in market value of securities available for sale. Return on equity as of March 31, 2023, increased to 12.87% compared to 10.76% for the same period last year. Book value per share as of March 31, 2023, was $135.32, compared to $128.69 as of Dec. 31, 2022. The bank’s March 31, 2022, Tier 1 leverage capital ratio of 10.20% remains above well-capitalized standards.

ABOUT FIRST NATIONAL BANK ALASKA

First National Bank Alaska files a quarterly financial report with the Federal Financial Institution Examination Council. The bank’s latest Consolidated Report of Condition and Income (Call Report) is filed by the 30th of the month following quarter-end and is subsequently posted at FNBAlaska.com and at OTCMarkets.com.

Alaska’s community bank since 1922, First National proudly meets the financial needs of Alaskans with ATMs and 28 locations in 19 communities throughout the state, and by providing banking services to meet their needs across the nation and around the world.

In 2022, Alaska Business readers voted the bank the “Best of Alaska Business” in the Best Place to Work category for the seventh year in a row and Best Bank/Credit Union for a second time. American Banker recognized First National in 2022 as a “Best Bank to Work For” for the fifth year running. In the same year, Anchorage Daily News readers voted the bank one of the state’s top three financial institutions for the fourth year in a row in the ADN “Best of Alaska” Awards.

First National Bank Alaska is a Member FDIC and Equal Housing Lender.