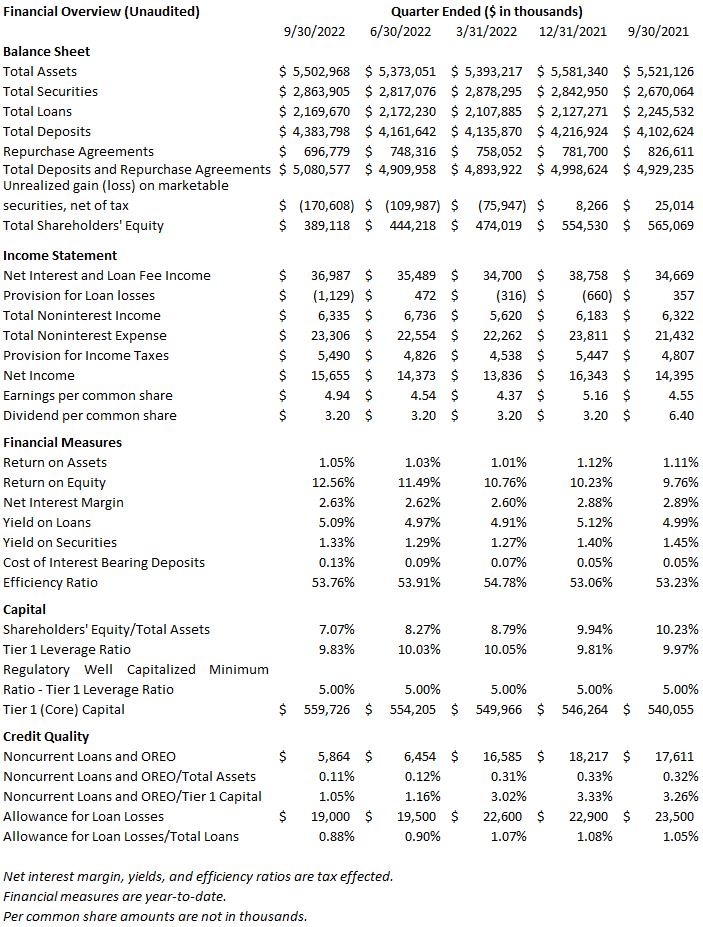

(ANCHORAGE) First National Bank Alaska’s (OTCQX:FBAK) unaudited net income for the third quarter of 2022 was $15.7 million, or $4.94 per share. This compares to net income of $14.4 million, or $4.55 per share, for the same period in 2021. Unaudited year-to-date net income was $43.9 million, or $13.85 per share, compared to $42.1 million, or $13.28 per share, for the same period in 2021.

“First National Bank Alaska is pleased to report another quarter of strong performance,” said Betsy Lawer, Board Chair and CEO/President. “We have successfully replaced non-recurring interest and fee income earned on the SBA PPP loan program with core earnings. Our customers and employees alike have proven themselves resilient and capable of navigating the changing business and banking environments.”

Return on assets through September 30, 2022 was 1.05%, a decrease from 1.11% for the same period last year, attributable to lower interest and fees on loans, increased interest expense, and lower average assets during 2021.

Assets totaled $5.5 billion as of September 30, 2022, decreasing $78.4 million year to date. Total loans increased $42.4 million to $2.2 billion with strong growth in real estate loans.

Total deposits and repurchase agreements reached $5.1 billion as of September 30, 2022, increasing $82.0 million year to date attributed to growth from business development efforts.

Interest and fees on loans decreased $3.2 million from the prior year to $81.7 million, on reduced interest and fees from SBA PPP loans. Interest and dividends on investment securities increased $6.9 million year-over-year to $29.4 million on increased volume.

The September 30, 2022 year-to-date net interest margin at 2.63% decreased from 2.89% as of September 2021. The blended yield on interest-earning assets decreased to 2.80% from 2.92% for the nine-month periods ending September 30, 2022 and 2021, respectively. Lower yields on earning assets resulted from a decrease in blended yield on securities as higher yielding investments matured later in 2021 and early in 2022, more than offsetting the improvement in blended loan yields from forgiveness of 1% PPP loans.

As of September 30, 2022, delinquent loans from 30 to 89 days were $0.7 million, 0.03% of outstanding loans, an increase of $0.6 million from December 31, 2021. Nonperforming loans were $5.8 million, 0.27% of outstanding loans, a decrease of $11.8 million from December 31, 2021. The allowance for loan losses at September 30, 2022 was $19.0 million, or 0.88% of total loans.

Noninterest income for the first nine months of 2022 decreased 3.2% from the same period in 2021. Bankcard fees and service charges increased year-over-year as consumer spending activity, offset by a decrease in mortgage loan origination income as home purchases and refinancing activity declined.

Noninterest expenses for the first nine months of 2022 increased 1.7% when compared to the same period in 2021. Salaries and employee benefits decreased year-over-year, reflecting improved management of healthcare costs and decreased headcount.

Notwithstanding continued strong operating results, the balance sheet is impacted by accounting adjustments related to the market value of securities held for investment and classified as available for sale. As the Federal Reserve continues to raise interest rates in an effort to combat inflation, bond prices are negatively affected.

With these interest rate changes, shareholders’ equity was $389.1 million as of September 30, 2022, compared to $554.5 million as of December 31, 2021, a decrease of $165.4 million. As a further impact of the reduction in shareholders’ equity, return on equity as of September 30, 2022 increased to 12.56% compared to 9.76% for the same period last year. Book value per share as of September 30, 2022 was $122.87, compared to $175.10 as of December 31, 2021.

The bank’s September 30, 2022 Tier 1 leverage capital ratio of 9.83% remains above well-capitalized standards. Regulatory capital rules for community banks allow the accounting adjustments related to the market value of securities to be excluded from regulatory capital ratios.

ABOUT FIRST NATIONAL BANK

First National Bank Alaska files a quarterly financial report with the Federal Financial Institution Examination Council. Our latest Consolidated Report of Condition and Income (Call Report) is filed by the 30th of the month following quarter-end and is subsequently posted at FNBAlaska.com and at OTCMarkets.com.

Alaska’s community bank since 1922, First National proudly meets the financial needs of Alaskans with ATMs and 28 locations in 19 communities throughout the state, and by providing banking services to meet their needs across the nation and around the world.

In 2021, American Banker recognized First National as a “Best Bank to Work For” for the fourth year in a row, and Anchorage Daily News readers voted the bank one of the state’s top three financial institutions for the third year in a row in the ADN “Best of Alaska” Awards. In 2022, Alaska Business readers voted the bank the “Best of Alaska Business” in the Best Place to Work category for the seventh year in a row and Best Bank/Credit Union for a second time.

Visit FNBAlaska.com for more information about Alaska’s largest locally owned bank and access to efficient and secure online banking services. First National Bank Alaska is a Member FDIC and Equal Housing Lender.