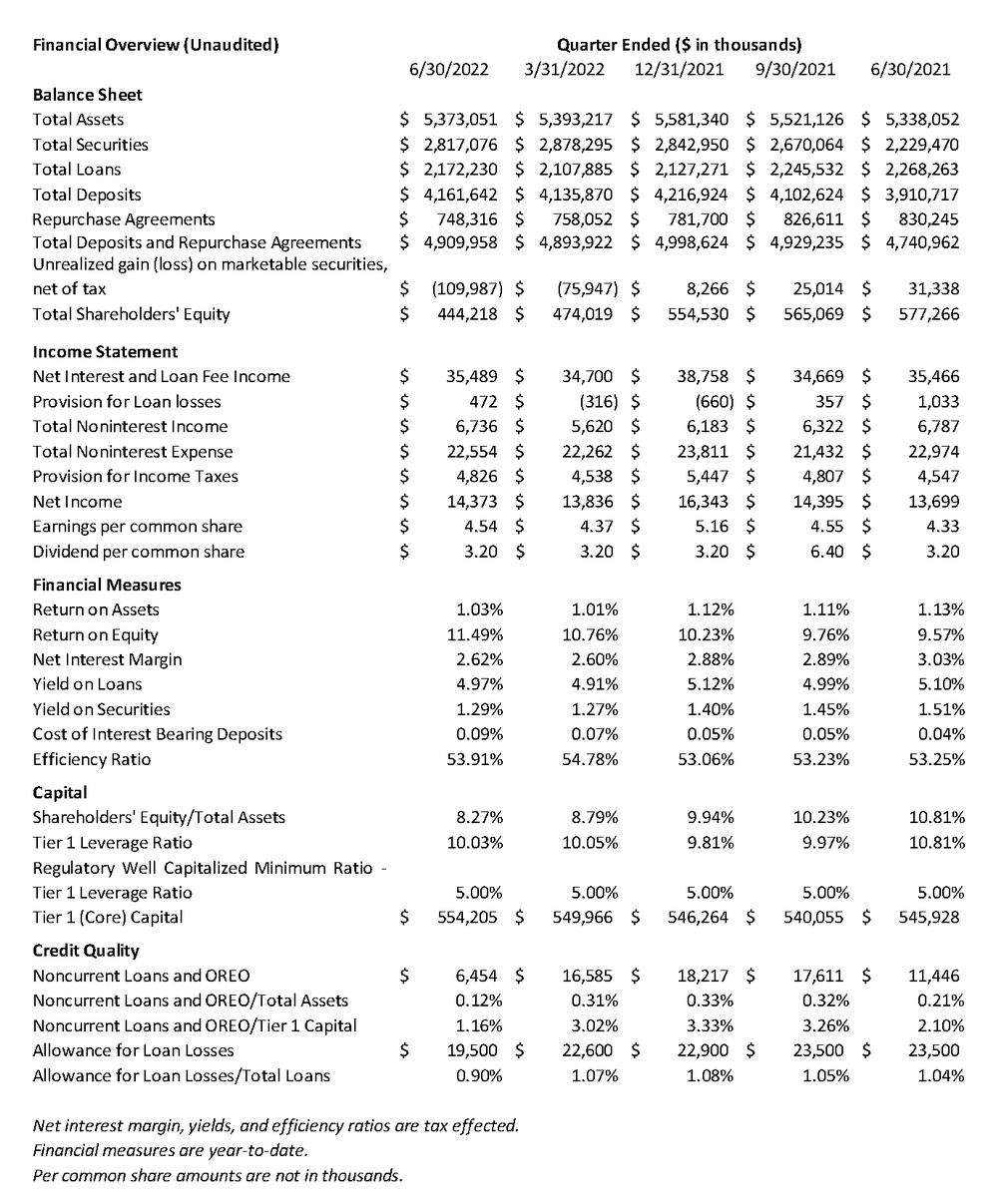

First National Bank Alaska’s (OTCQX:FBAK) unaudited net income for the second quarter of 2022 was $14.4 million, or $4.54 per share. This compares to a net income of $13.7 million, or $4.33 per share, for the same period in 2021. Unaudited year-to-date net income was $28.2 million, or $8.91 per share, compared to $27.7 million, or $8.74 per share for the same period in 2021.

“First National Bank Alaska continues to perform well in our Centennial year with net income and earnings per share outpacing 2021,” said Betsy Lawer, Board Chair and CEO/President. “Our commitment to our employees and communities was highlighted again as the bank was voted Best Place to Work in the Best of Alaska Business Awards for the seventh year in a row and as Best Bank for the second time.”

Assets totaled $5.4 billion as of June 30, 2022, decreasing $208.3 million year to date. Total loans increased $45.0 million to $2.2 billion, with strong growth in real estate loans. Return on assets for the six months ending June 30, 2022 was 1.03%, decreased from 1.13% for the same period last year. At that time, total assets were lower by $35.0 million at $5.3 billion.

Total deposits and repurchase agreements reached $4.9 billion as of June 30, 2022, decreasing $88.7 million year to date on seasonal customer utilization of cash balances.

Interest and fees on loans decreased $5.3 million from the prior year, a result of reduced interest and fees on SBA PPP loans. Interest and dividends on investment securities increased $4.3 million year-over-year on increased volume and yield improvements.

The blended yield on interest-earning assets decreased to 2.70% from 3.07% for the six-month periods ending June 30, 2022 and 2021, respectively, but increased six basis points since March 31, 2022 due to increasing interest rates. Lower yields on earning assets resulted from variable loan repricing, the outstanding SBA PPP loans, and significant cash and short-term investments. The year-to-date net interest margin moved to 2.62% compared to 3.03% in June 2021 on lower yields on earning assets.

Total loans decreased $96.0 million year-over-year. Outstanding SBA PPP loans totaled $31.2 million and $295.7 million as of June 30, 2022 and 2021, respectively, a decrease of $264.5 million. Through the second quarter of 2022, First National’s SBA PPP borrowers received forgiveness totaling $551.0 million over the life of the program.

As of June 30, 2022 delinquent loans from 30 to 89 days were $5.1 million, 0.24% of outstanding loans excluding SBA PPP loans, an increase of $5.0 million from December 31, 2021. Nonperforming loans were $6.4 million, 0.30% of outstanding loans excluding SBA PPP loans, a decrease of $11.2 million from December 31, 2021. The allowance for loan losses at June 30, 2022 was $19.5 million, 0.90% of total loans.

Noninterest income for the first six months of 2022 decreased 4.8% from the first six months of 2021. Bankcard fees and service charges increased year-over-year as consumer spending activity picked back up following the pandemic lockdowns, offset by a decrease in mortgage loan origination income as home purchases and refinancing activity declined.

Noninterest expenses for the first six months of 2022 decreased 1.6% when compared to the same period in 2021. Salaries and employee benefits decreased year-over-year reflecting improved management of healthcare costs and decreased headcount. Professional services and general business expenses are slowly returning to pre-pandemic levels.

Shareholders’ equity was $444.2 million as of June 30, 2022, compared to $554.5 million as of December 31, 2021, a decrease of $110.3 million resulting from a continued decrease in market value of securities available for sale as market interest rates continue to rise. The bank generally holds securities to maturity in which case unrealized losses are temporary. Return on equity as of June 30, 2022 increased to 11.49% compared to 9.57% for the same period last year. Book value per share as of June 30, 2022 was $140.27, compared to $175.10 as of December 31, 2021. The bank’s June 30, 2022 Tier 1 leverage capital ratio of 10.03% remains above well-capitalized standards.

First National Bank Alaska files a quarterly financial report with the Federal Financial Institution Examination Council. Our latest Consolidated Report of Condition and Income (Call Report) is filed by the 30th of the month following quarter-end and is subsequently posted at www.FNBAlaska.com > Financial Reports and at www.OTCMarkets.com.

Alaska’s community bank since 1922, First National proudly meets the financial needs of Alaskans with ATMs and 28 locations in 19 communities throughout the state, and by providing banking services to meet their needs across the nation and around the world.

In 2021, American Banker recognized First National as a “Best Bank to Work For” for the fourth year in a row, and Anchorage Daily News readers voted the bank one of the state’s top three financial institutions for the third year in a row in the ADN “Best of Alaska” Awards. In 2022, Alaska Business readers voted the bank the “Best of Alaska Business” in the Best Place to Work category for the seventh year in a row and Best Bank/Credit Union for a second time.

Visit FNBAlaska.com for more information about Alaska’s largest locally owned bank and access to efficient and secure online banking services. First National Bank Alaska is a Member FDIC and Equal Housing Lender.