-

How do I authorize First National to discuss my account information with someone other than me?

Download the Preferred Communication form at FNBAlaska.com/escrow. Complete, sign and return the form to any First National location or by mail to:

First National Bank Alaska

Escrow Services

PO Box 100720

Anchorage, AK 99510-0720 -

Where can I find a copy of my year-end statement?

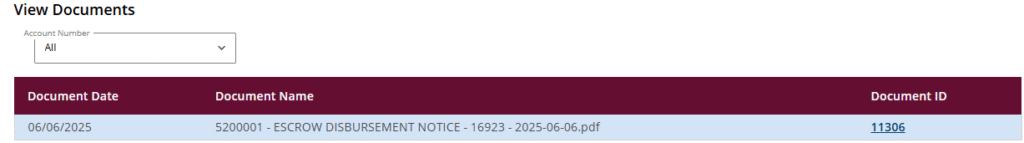

Year-end statements are mailed to customers in January. A reproduction may be requested for a fee. If you need an additional copy, call 907-777-3430 or email escrow@fnbalaska.com. Beginning January 2026, customers will be able to review a copy of their year-end statement through the online customer portal under the Documents tab.

-

Can I update my address over the phone?

No. To update your contact information, download the Change of Address and Contact Information form at FNBAlaska.com/address. Print, complete and return the form to any First National location or by mail to:

First National Bank Alaska

Escrow Services

PO Box 100720

Anchorage, AK 99510-0720 -

Can I call Escrow Services to make a payment?

No. Customers can make payments via:

- Any device with internet by accessing the Escrow Online Customer Portal.

- Bill Pay through their financial institution.

- Wire transfer – contact Escrow Services for further instructions.

- In person at any First National branch.

Or by mail to:

First National Bank Alaska

Escrow Services

PO Box 100720

Anchorage, AK 99510-0720 -

Why did I get charged a late fee?

There are several reasons why a payment may incurring a late fee. They include:

- Payment was received outside of the grace period.

- Payment was short of the full installment amount.

- Other fees may have been incurred, such as the annual fee.

For more information on why late fees were applied to your account, contact Escrow Services at 907-777-3430 or email escrow@fnbalaska.com. -

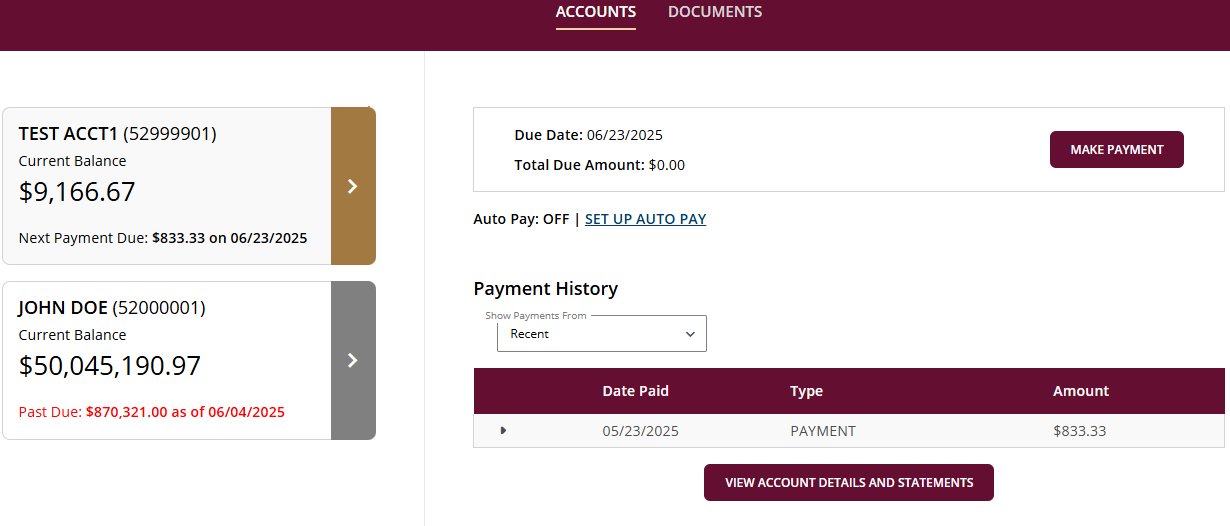

How do I know when my next payment is due?

- Log in to the Escrow Online Portal.

- Click on the account with the due date you would like to see.

- The payment due date will show at the top of the screen with an option to make a payment.

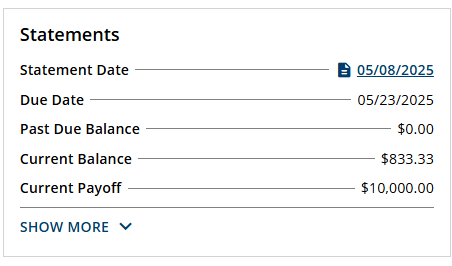

Users can also view the billing invoice by clicking on the View Account Details and Documents button.

Scroll down and click on the desired statement date.- Scroll down and click on the desired statement date.

- This will bring up the billing invoice.

- The payment due date will be listed, along with any past-due balance, current balance and current payoff amount.

-

Will my direct deposits be affected?

No. Your direct deposit will not be affected.

-

What is Multi-Factor Authentication (MFA) and how does it relate to the online and mobile banking upgrade?

Multi-Factor Authentication (MFA) is a security feature that requires users to input a code sent to their phone in order to access their bank account via the online portal or mobile app. First National is enhancing our MFA system for online and mobile banking to strengthen security and protect against fraud and identity theft, ensuring that you or your designated users are the only people who can access your online banking portal.

-

How do I update my contact information?

Personal banking customers

- Log in to Personal Online Banking

- Select Profile from the upper navigation bar

- Select Edit next to Email and Phone and update as needed

- Select View next to Address and update as needed

Business banking customers

Note – Only System Administrators can update user information on business accounts.

- Log in to Business Online Banking

- Select Administration from the upper navigation bar

- Select Inquire Employee and click Submit

- Select each employee and review their Contact Methods section

- Click the change icon to make any necessary updates, then click the save icon.

You can also update your contact information by visiting a branch or calling our Contact Center.

-

How can I prepare?

- Verify and update your contact information. The new banking platform will use enhanced multifactor authentication (MFA) to send a one-time access code to the phone number listed in your online banking portal. Learn how to update your contact information by clicking on a guide below.

- Also, make sure you know your login credentials as you will need them to access the new platform.

-

Who is affected?

All online and mobile banking customers will experience the enhanced platform.

-

When is the upgrade happening?

We will launch our new online and mobile banking platform in 2026. Stay tuned for more information.

Page 1 of 10