Putting You First

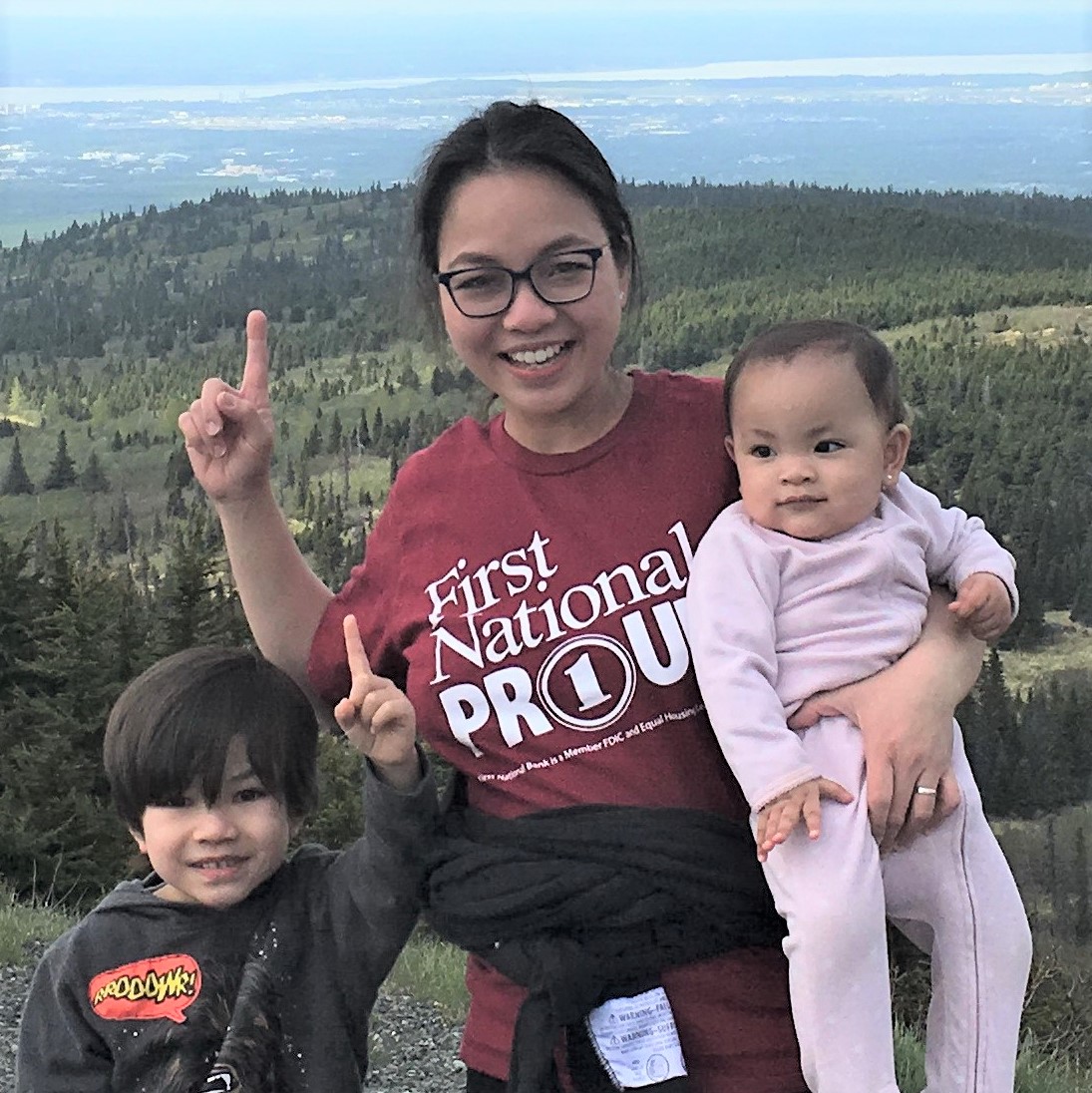

Experienced, friendly Alaskans are available to help customize the right solutions to meet your unique financial needs. Here's what our customers have to say.

Shaping Tomorrow Since 1922

We are First National Proud to be Alaska’s community bank. With a century of experience and community investment, we'll help you shape a brighter tomorrow.

First National Proud

Our roots are firmly planted in the communities and industries that drive Alaska’s economy.